Your Search for a

has come to a good end

With comprehensive features and unmatched performance, find out why our system is one of Kenya's Most Beloved solution for MFIs and Digital Lenders

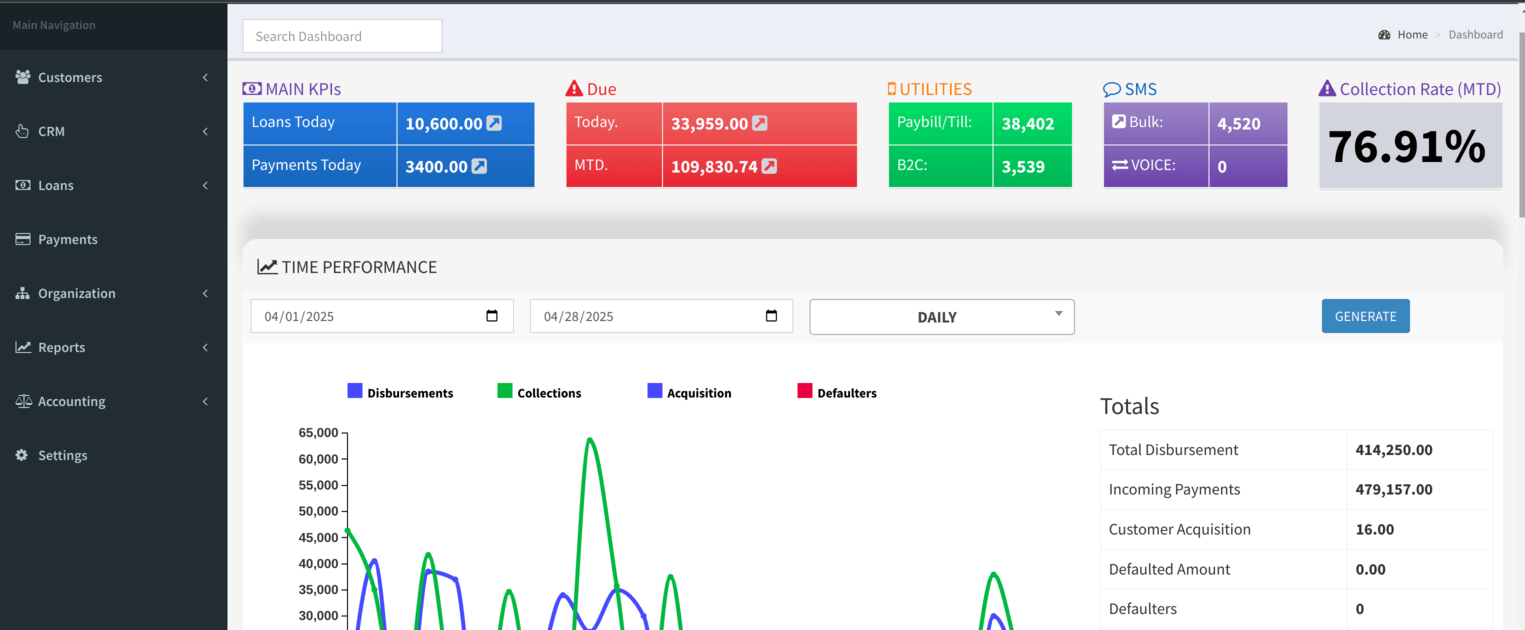

Running a growing MFI? Superlender handles the pressure with ease — from your first hundred clients to your first hundred thousand. You focus on expanding, we’ll keep everything running.

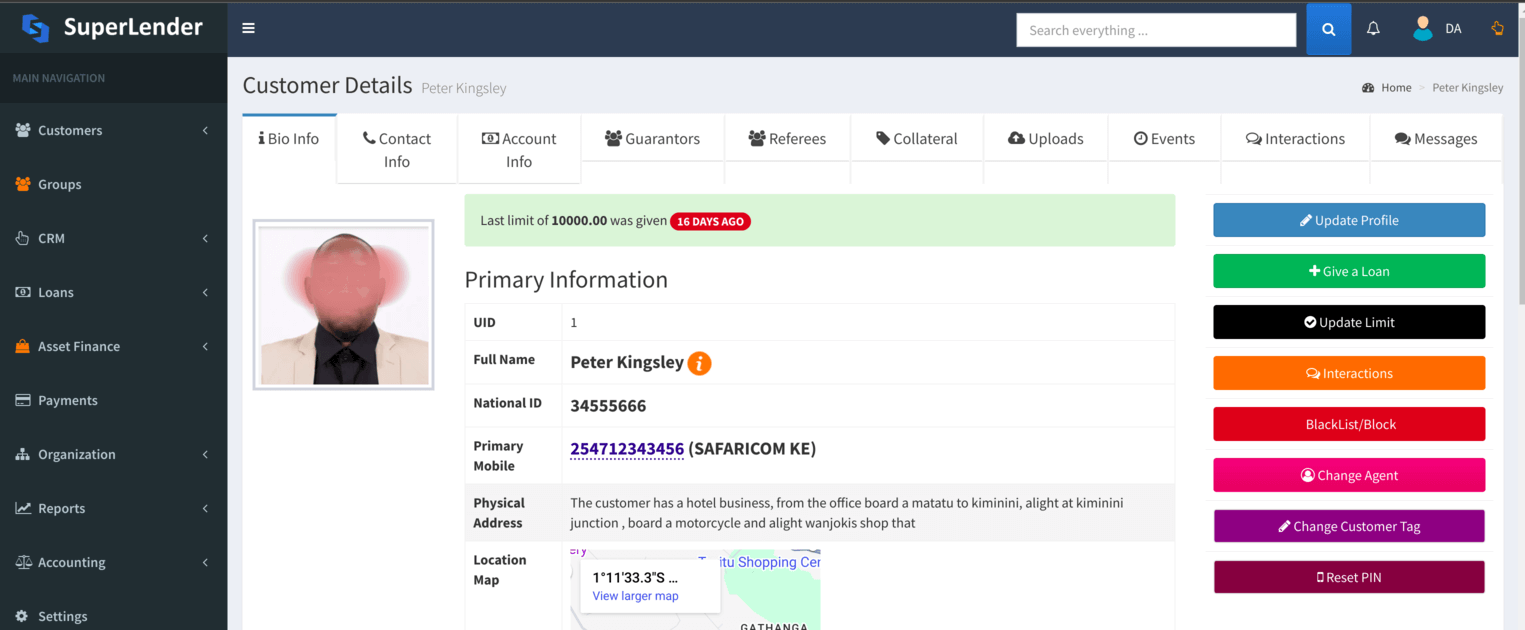

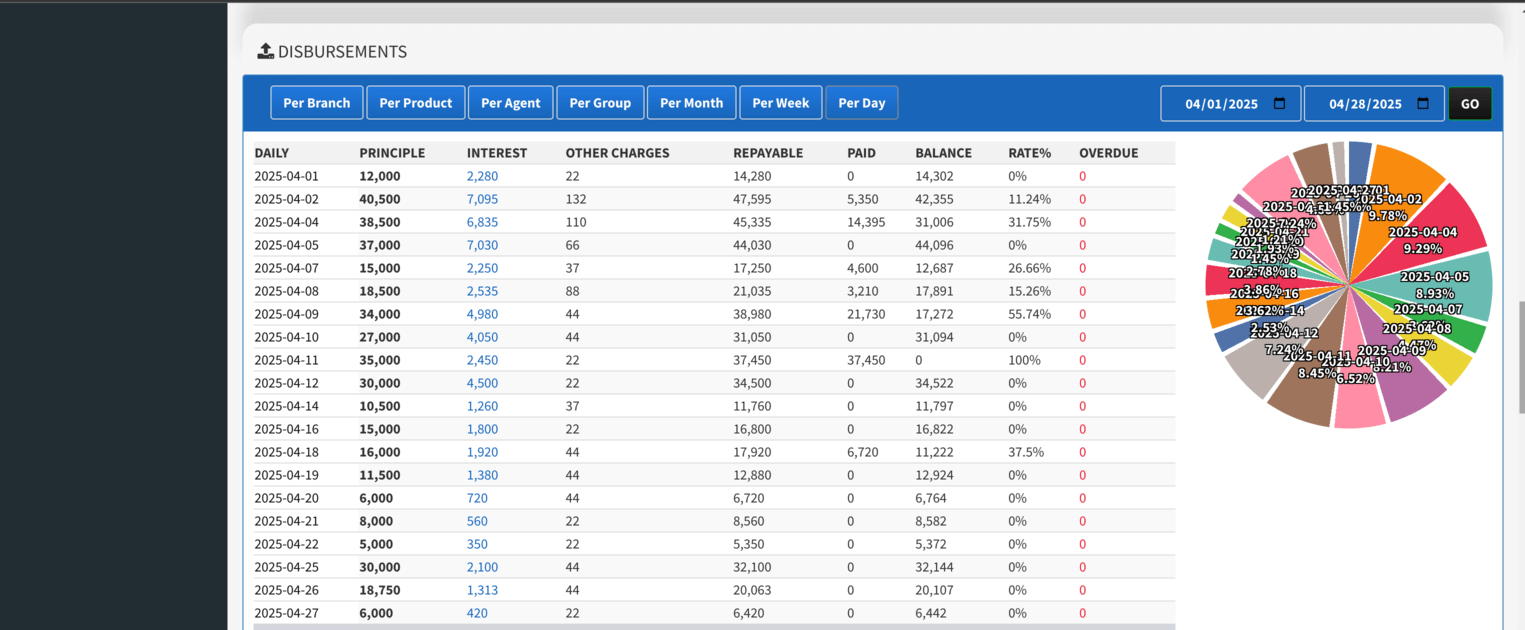

Loan tracking, customer profiles, reports, reminders — it’s all built in. Superlender has what your team needs, right when they need it. No more jumping between systems.

So fast, you’ll have to keep up! Whether it’s loading reports or processing loan applications, Superlender runs at the speed of your ambition.

We guard your data like it’s our own. Superlender’s advanced security keeps your business safe from outside threats and internal mistakes — so you can sleep easy.

Every MFI works differently — and that’s exactly why Superlender is built to adapt. Create your own forms, products, and workflows. It works the way you do, not the other way around.

Our loan management software comes packed with all the features you need to streamline your operations and provide exceptional service to your customers.

Trusted by Kenya’s top microfinance institutions, Superlender delivers enterprise-level performance with flexible, scalable pricing. Designed to grow with your business, it's the smart choice for both industry leaders and ambitious startups.

Hear what our clients have to say about their experience with Superlender.

Experience the power of Superlender with a free, no-obligation online demo. Add a customer, create a loan, review the reports. It's all there

Free DemoWhether you are starting or are an established institution with hundreds of branches, we have a pricing model that takes care of everyone. From a SAAS model to a Purchase model, you will fit right in

Our team is ready to answer your questions and help you get started with Superlender.